Révolutionner l'inclusion financière dans les pays émergents

Renforcer les économies avec des solutions blockchain ancrées dans la confiance et la transparence.

Renforcer les économies avec des solutions blockchain ancrées dans la confiance et la transparence.

Par sa conception même, la blockchain apporte un niveau inégalé de fiabilité.

Les smart contracts procurent la transparence et la sécurité des historiques.

Soyez parmi les premiers à bénéficier de notre service à prix super compétitif et recevez un coupon d'essai gratuit !

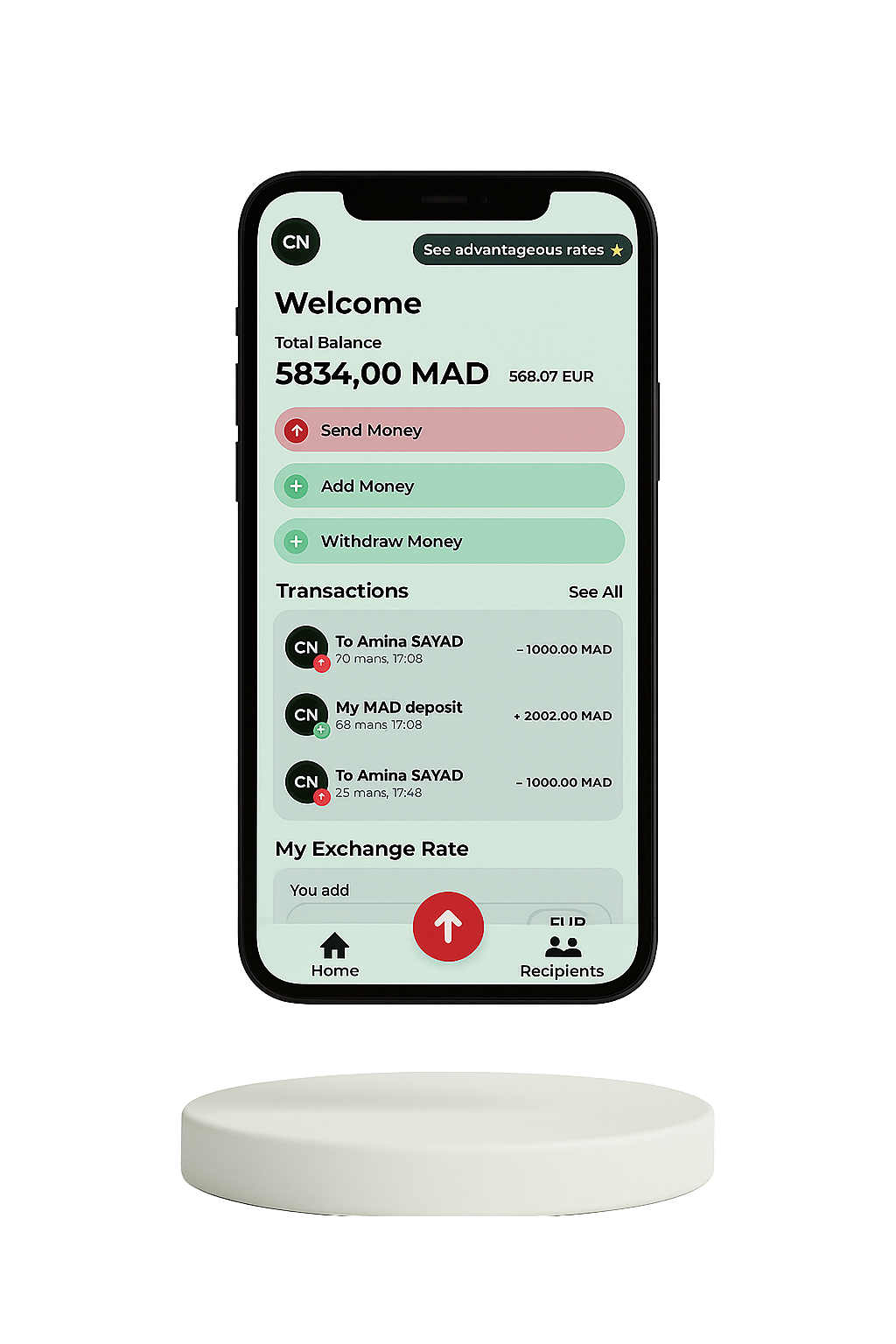

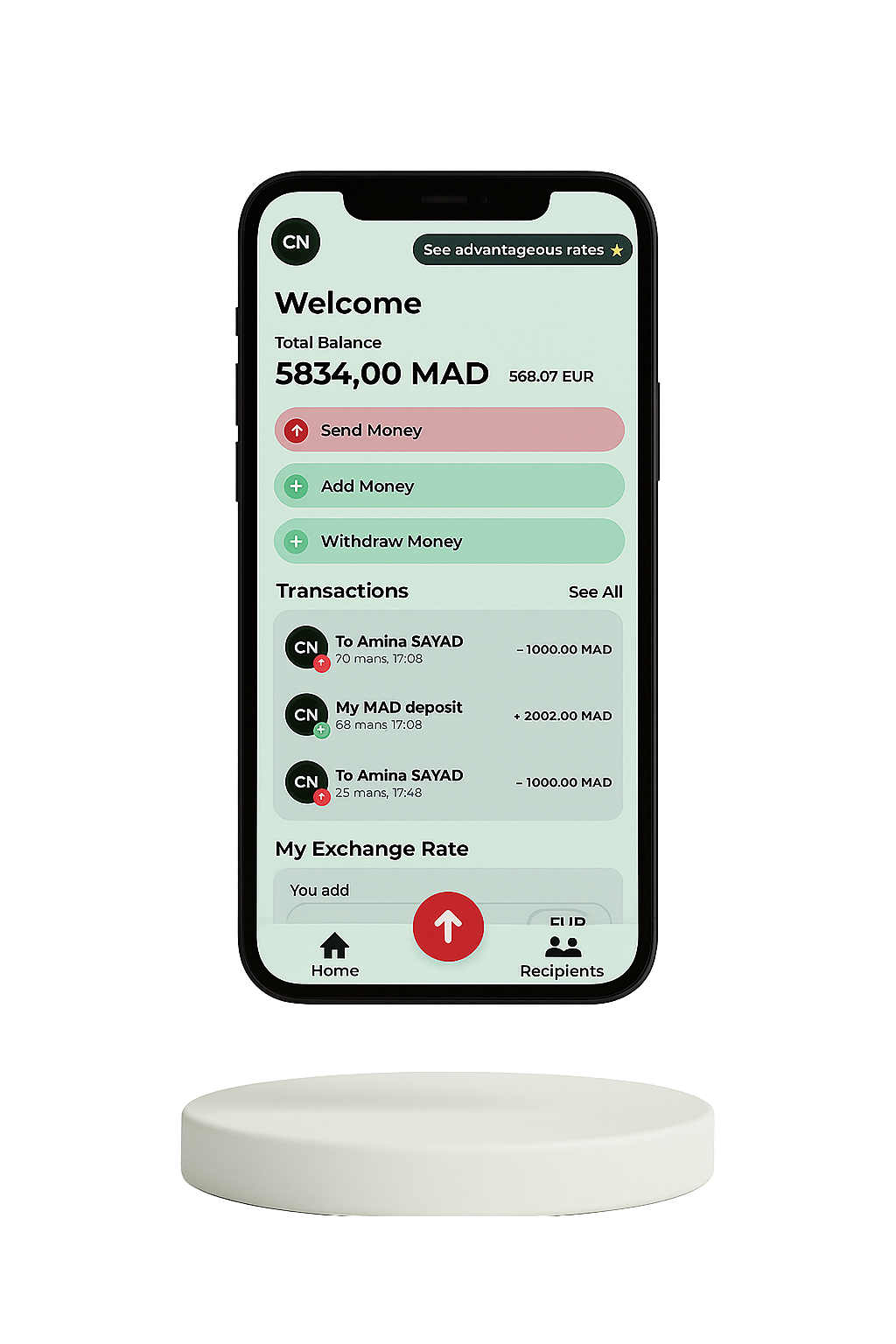

Transfert d'argent

Permet des transferts d'argent de particulier à particulier, entre l'expéditeur en Europe

et le destinataire dans les pays émergents, via notre application mobile ou notre site web.

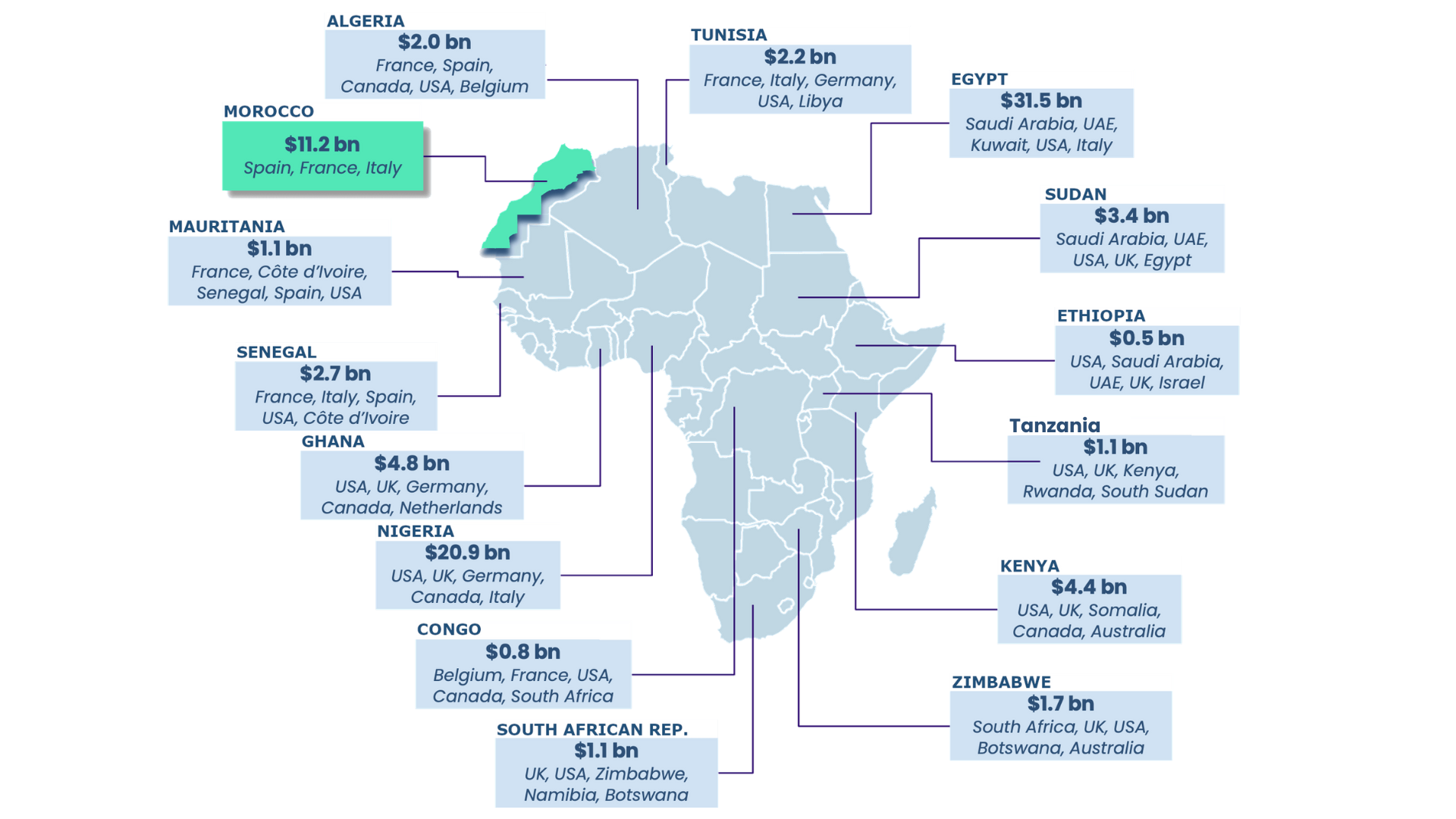

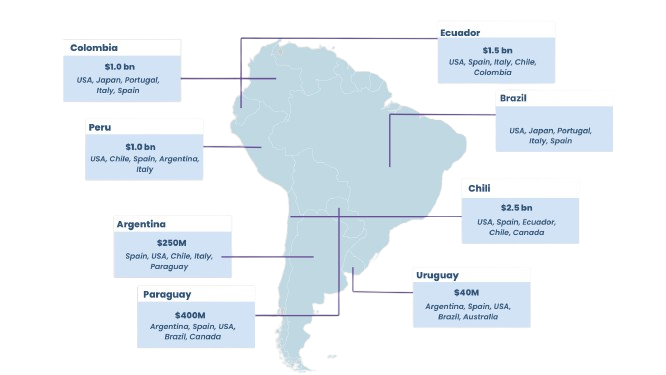

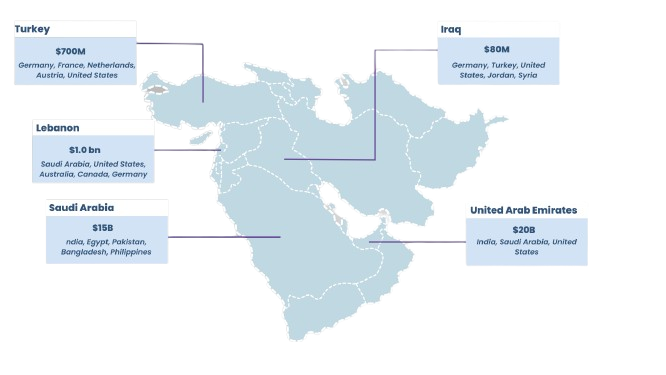

Notre ambition est de transposer ce modèle dans les principaux pays récepteurs de transferts d'argent, avec des marques adaptées au diaspora des pays de réception, dans les zones Amérique Latine, Afrique et Moyen Orient.

En savoir plus →